The Importance of CFP® Exam Prep in Holistic Financial Planning

In the dynamic landscape of finance, where sound decisions can pave the way to prosperity, stands a coveted credential that distinguishes the truly exceptional – the Certified Financial Planner™. Like a compass guiding you toward victory, this certification signals not only competence but also an unwavering commitment to excellence in the world of financial planning.

As the financial industry continues to evolve, the CFP® exam certification stands as a testament to your dedication and expertise, setting you apart from your peers. With this prestigious designation in your arsenal, you possess a powerful advantage that can elevate your career to new heights.

In this article, we’ll unravel the importance of the CFP® exam and explore how it empowers you with a unique edge over others in the financial planning arena. Let’s uncover how CFP® exam preparation shapes financial strategists into well-rounded experts capable of addressing clients’ financial goals with a holistic approach.

1. A test of comprehensive knowledge

The CFP® exam is the pinnacle of financial planning assessments, designed to evaluate a candidate’s understanding of diverse monetary disciplines. From investment management and retirement planning to estate planning and risk management, the exam tests professionals on their ability to analyze intricate scenarios and devise all-encompassing financial strategies. CFP® exam preparation ensures that individuals are well-versed in these multiple facets, allowing them to offer customers a more thorough and informed financial roadmap.

2. Holistic approach to client relationships

The CFP® exam emphasizes a client-focused approach, where professionals must understand the unique needs and circumstances of each individual or family seeking financial guidance. Through extensive preparation, aspiring CFP® exam professionals learn to listen actively, ask pertinent questions, and develop an empathetic understanding of consumers’ financial goals.

This comprehensive approach fosters more meaningful and long-lasting relationships with consumers, built on trust and a deep understanding of their aspirations.

3. Real-world application of knowledge

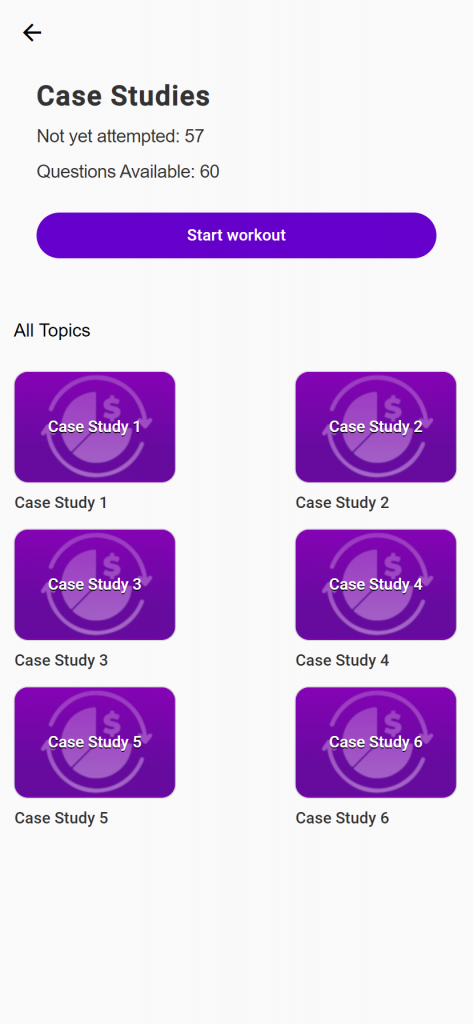

CFP® exam goes beyond theory, encouraging real-world application. Preparing for the CFP® exam enhances problem-solving through practical case studies and simulations, and helps aspirants to gain valuable experience. This equips them to confidently tackle complex financial situations, offering tailored and innovative solutions. To improve their skills further, entrants can practice case simulations on CFP® Exam Prep by Achieve App. This would enable them to solve even the most intricate case scenarios with expertise and precision.

4. Fostering multidisciplinary collaboration

The CFP® exam cultivates interdisciplinary cooperation, emphasizing the importance of integrating knowledge across different financial domains. Financial advisors encounter scenarios that require collaboration between specialists, preparing them to provide comprehensive solutions that address clients’ unique needs effectively. This approach ensures that professionals can engage with diverse fields and deliver holistic financial services that lead clients toward their long-term goals.

An example can be – a customer is approaching retirement. A Certified Financial Planner™ needs to analyze the investment portfolio, assess the tax implications, recommend appropriate insurance coverage, and develop an estate plan to ensure a smooth transition of assets to the beneficiaries. This process demands collaboration between specialists in different financial fields, each contributing their expertise to create a cohesive and tailored monetary plan.

5. Mastering tax efficiency

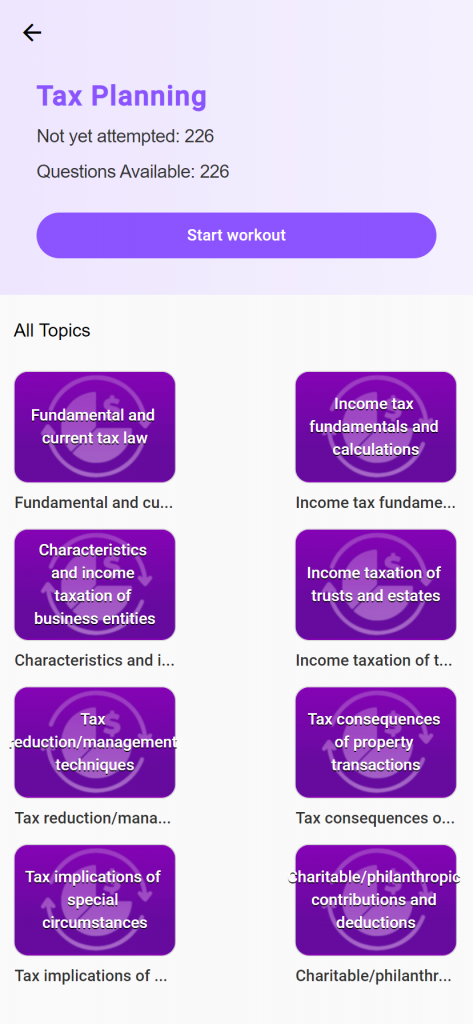

Tax planning is a critical aspect of financial management. CFP® exam prep includes a focus on tax-efficient strategies, such as tax-loss harvesting and retirement account optimization. By mastering tax efficiency, CFP® exam certified professionals can maximize clients’ after-tax returns and preserve more of their hard-earned wealth.

In addition to honing their skills during exam preparation, aspiring financial planners can take their knowledge to the next level by engaging with MCQs specifically tailored to tax planning. By utilizing the CFP® Exam Prep by Achieve, aspiring candidates can delve deeper into intricate tax laws and regulations. This allows them to provide more informed and effective advice to their future clients.

6. Adapting to market volatility

The financial world is no stranger to market fluctuations and economic uncertainties. CFP® exam preparation equips professionals with the analytical skills needed to navigate these challenges effectively. By understanding risk management, asset allocation, and investment strategies, CFP® exam aspirants can guide customers through turbulent times and help them stay on track toward their long-term economic goals.

Conclusion

In a nutshell, preparing for the CFP® exam is a crucial step in becoming a well-rounded financial planner. As you embark on this transformative journey, you’ll enhance your expertise in various financial areas, learn to practice ethics and put your client’s needs at the forefront. But it doesn’t stop there! To take your financial knowledge to the next level, engage with real-world scenarios – stay updated on market trends and tax changes, keeping your finger on the pulse of the financial world.

Don’t underestimate the power of regular revision and mock tests in CFP® Exam Prep by Achieve. They hone your skills, boost your confidence, and equip you to tackle any financial challenge with flair. With a diverse skill set and commitment to growth, you’ll be a capable, adaptable professional, guiding consumers to financial wins with dedication and faith.